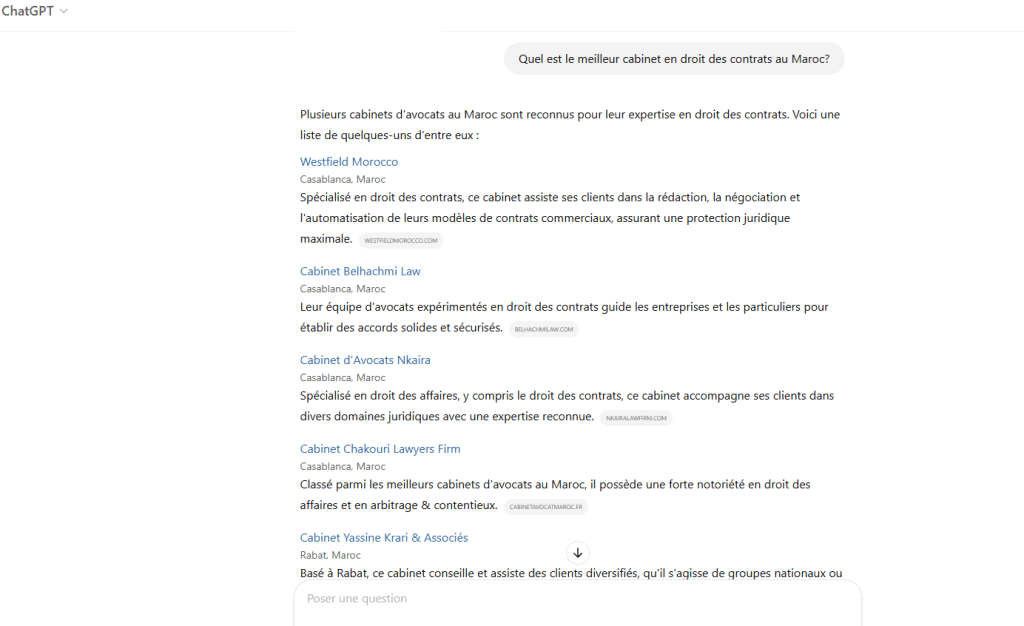

Business Law Firm specialized in legal and Tax advice

Introduction

Choosing the right legal structure is a crucial step for any business, especially for small and medium-sized enterprises (SMEs) in Morocco. The majority of Moroccan SMEs prefer the limited liability company (SARL) form, due to its simplicity and low operating costs. However, changes in the legal framework have recently introduced the simplified joint stock company (SAS), offering entrepreneurs new options and innovative prospects. This article takes an in-depth look at the advantages and specific features of the SARL and SAS, highlighting the significant differences that can influence entrepreneurs’ decisions.

The SARL, the classic structure for SMEs in Morocco, is appreciated for its operational flexibility. Its operation requires only a manager, eliminating the need to set up a board of directors. This, coupled with the absence of any obligation to appoint an auditor, makes it an economical option. The SARL can be set up by a single individual or legal entity, offering great flexibility in the shareholder structure with no minimum share capital requirement.

Act no. 19-20 supplementing and amending Act no. 17-95 on public limited companies introduced the SAS into the Moroccan legal landscape, widening the choice of structures available to SMEs. Henceforth, the articles relating to the SAS are set out in articles 43-1 et seq. of the same law. The liability of SAS partners is limited to the amount of their capital contributions, thus providing additional protection. A distinctive feature of the SAS is its flexible corporate governance, allowing the partners to define the operating rules. This flexibility makes it possible to personalize governance and separate power from capital, offering an adaptability rarely found in other structures.

Comparative study: SARL/ SAS

Legal representation of limited liability companies (SARL) and simplified joint stock companies (SAS):

SARLs are managed by one or more natural persons, generally designated as manager(s), with broad powers to act on behalf of the company. In the case of co-management, each co-manager has the same powers. However, it is advisable to specify in the Articles of Association whether a single signature is sufficient to bind the company, or whether a co-signature is required.

The SAS is managed by one or more individuals or legal entities, and is represented vis-à-vis third parties by a Chairman, whose powers are very broad, “within the limits of its corporate purpose”. Clauses in the articles of association limiting the powers of the Chairman are not enforceable against third parties. An SAS can have only one chairman, ruling out co-chairmanship. However, there are ways of circumventing this rule, such as appointing a SARL with two co-managers as chairman of the SAS, or introducing a rotating chairmanship. In addition to the chairman, the SAS may have other statutory officers, whose legal status is set out in the articles of association. By way of example, an officer may be appointed as managing director. The latter will exercise his mandate under the conditions defined in the bylaws. Such officers must appear on model J. An important feature is that the chairman and statutory officers of the SAS may be legal entities, which is not the case for the manager of the SARL.

Concrete example – SAS presided by a legal entity:

A concrete example illustrating the flexibility of the SAS is the possibility of having a legal entity as president. This can be advantageous for groups of companies, offering an alternative to

groups, offering an alternative to management fees for transferring funds from subsidiaries to the parent company. For example, appointing the parent company as “chairman” of its subsidiaries incorporated as SAS may justify a portion of the amounts paid by the subsidiary to the parent company, without any particular formalities in the event of a change of management at parent company level.

Management of regulated agreements

This differs between SARLs and SASs, with a degree of flexibility offered by the SAS in the absence of a statutory auditor. In a SARL, agreements with managers or partners require a report by the manager or the statutory auditor, presented to the partners.

In a SAS, on the other hand, a report on agreements with the Chairman or executive officers is presented by the statutory auditor, without any obligation to present it to the partners in the absence of a statutory auditor. In fact, it is specified that regulated agreements only apply to agreements with the Chairman or senior management, leaving a legal vacuum with regard to agreements with associates. Thus, the legislation does not seem to explicitly govern agreements between the SAS and its associates, creating a notable gap in the regulatory framework.

The drafting of the Articles of Association thus becomes a key element in defining the terms and conditions of agreements with associates, filling the existing legislative void and ensuring clear and equitable governance within the SAS.

Company shares :

Introduction to Share Structure in SARLs and SASs:

The nature of a company’s shares is of strategic importance in defining its capital structure. For limited liability companies (SARLs) and simplified joint-stock companies (SASs), the legal provisions governing shares have distinct characteristics. A closer look at these provisions, particularly those relating to SARLs and SASs, reveals significant differences that influence entrepreneurs’ capital structure choices.

SARL shares – Non-negotiable nature:

In SARLs, Articles 54 and 55 of Law 5-96 clearly state that shares may not be represented by negotiable securities. Moreover, an SARL is explicitly prohibited from issuing securities. This provision reflects a more traditional approach, rooted in the stability and confidentiality of relations within the SARL.

Shares in a SAS – Free transfer subject to the Articles of Association :

By contrast, the SAS, as a joint-stock company, takes a more flexible approach. The transfer of SAS shares is free by default, unless otherwise specified in the Articles of Association. Unlike the SARL, there is no statutory approval procedure for the SAS under Law 5-96. However, the freedom of contract that governs the SAS allows restrictions to be placed on the free transferability of shares in the articles of association.

The nature of shares in SARLs and SASs reflects their respective capital structure philosophies. The SARL favors stability and confidentiality of relationships, while the SAS opts for a more flexible approach, emphasizing the contractual freedom of associates. These nuances need to be taken into account when choosing a legal structure, depending on the specific needs of each company.

Issuance of securities :

Issuance of securities within the SAS framework:

The SAS offers significant latitude when it comes to issuing composite securities, providing essential leverage in structuring complex operations such as capital investments. These securities, with their diverse characteristics, open up strategic and financial prospects for companies, particularly when investment funds are involved. The flexibility offered by the SAS in this area is particularly advantageous, freeing it from the restrictive formalities usually associated with public limited companies (SA).

Strategic objectives of Compound Securities :

The use of these instruments in private equity transactions aims to achieve three main objectives:

Reinforce Management Confidence: By granting securities such as BSAs to executives, the SAS encourages confidence by offering direct access to the company’s capital.

Diversification of financing options: For investors, issuing composite securities enables diversification of financing sources, combining elements of debt and equity to manage risk.

Investment protection: OCAs and ratchet mechanisms offer protection mechanisms, allowing equity participation to be relisted in specified circumstances, thus protecting core equity investments.

This flexibility in issuing securities is a major asset for SAS, helping to create innovative financial structures tailored to the specific needs of companies and investors.

The SAS as a subsidiary-building tool:

The SAS is a particularly well-suited strategic choice for filialisation, offering a flexible structure that meets the specific needs of companies wishing to create and own subsidiaries. This model is particularly advantageous in the case of a company newly created in Greenfield, where the subsidiary is 100% owned.

Customized Articles of Association for Group Policy:

The SAS allows for extensive customization of bylaws, providing an ideal framework for incorporating specific rules linked to group policy. This proactive approach enables the parent company to define key parameters for the management of its subsidiary. Elements that can be included in the bylaws include:

Clauses limiting the powers of the Chairman: The SAS offers the possibility of introducing clauses limiting the powers of the Chairman, thus clearly defining the scope of his actions and preserving consistency with the group’s overall strategy.

Specific procedures for approving decisions: Customized bylaws enable specific procedures to be established for the approval of important decisions, ensuring governance in line with the Group’s strategic orientations.

Existence of Specific Thematic Committees: The Articles of Association can provide for the creation of thematic committees dedicated to crucial areas such as Corporate Social Responsibility (CSR), compliance, investments, and other strategic aspects. These committees reinforce the specialized management of issues specific to the subsidiary.

The SAS, as a spin-off tool, thus enables precise adaptation of the organizational structure, facilitating the implementation of governance mechanisms in line with the Group’s objectives and values. This statutory flexibility strengthens the Group’s ability to exercise strategic control over its subsidiaries, while offering a degree of operational autonomy.

Joint venture:

In the context of a joint venture, the partners of a SAS can set up a governance structure based on collegial bodies such as audit, strategic or financial committees.

In addition to providing internal checks and balances, these committees can monitor the actions and decisions of management:

– By-laws governing their operation can be freely drawn up, and procedures can be extremely flexible.

– Shareholder management is simplified, as members of statutory committees are not required to hold shares in the company.

– The existence of committees responsible for overseeing the legal representative secures the company’s governance for the foreign partner, without the need for the latter to hold a corporate office in the company and incur the associated liability

Share capital increase:

In an SAS, the partners enjoy extensive freedom to organize their decision-making, defined by the Articles of Association. The bylaws must specify a number of points, such as how decisions are to be taken by the partners, how General Meetings are to be convened, the majority required, any quorum, and the division of powers between the partners and the Chairman.

Although none of the articles 43-1 et seq. requires certain decisions to be taken by ordinary or extraordinary general meeting (as was the case with the former article 436 of Law 17-95 on simplified joint stock companies), it would be prudent to take certain decisions by means of a general meeting (capital increase, capital reduction, merger, liquidation, etc.), and more specifically those involving amendments to the articles of association. As a result, SAS bylaws need to be very precise on all these issues, and must leave no stone unturned, since Law 5-96 leaves SAS partners entirely free to decide how they wish to make their decisions.

This is a major advantage over the SARL, since the partners can introduce a high degree of flexibility into the way the company operates, which will undoubtedly contribute to faster, less formal decision-making.

On the other hand, the SARL follows more formal rules, defined in articles 71 et seq. of Law 5-96. These rules impose a time limit for convening the meeting, which must be convened by registered letter, and a meeting convened by the manager or the statutory auditor.

Resolutions are passed by one or more partners representing at least half of the shares. If this threshold is not reached at the 1st meeting, the associates are convened a second time and decisions are taken by a majority vote, regardless of the number of votes cast; amendments to the bylaws are decided by associates representing at least three-quarters of the share capital. In addition, article 71 of Law 5-96 allows SARL partners to take certain decisions (with the exception of the annual approval of company accounts) by written consultation, without convening a general meeting. However, this option must be provided for in the company’s articles of association. Unfortunately, articles 43-1 et seq. of Law 5-96 do not contain any specific provisions concerning shareholders’ decisions to be taken at a general meeting.

Approval of transfer of shares :

For SAS :

In a SAS, shares are generally freely transferable, without any legal approval procedure being required under Law 5-96. However, the contractual freedom inherent in the SAS allows restrictions to be included in the Articles of Association, such as the inalienability of shares for a maximum period of ten years, or a prior authorization procedure for any transfer. The Articles of Association must clearly define the term “transfer” and specify the body responsible for approving transfers, as well as the procedure to be followed if approval is refused. Unlike other legal forms, approval may even be required between partners, thus introducing a dimension of intuitu personae within the SAS.

For SARL :

The SARL requires approval by the partners for any transfer of shares to third parties. This process involves notification to the company and the partners, with a right of revendication within thirty days in the event of refusal of approval.

“Shares may only be transferred to third parties with the consent of a majority of associates, representing at least three-quarters of the shares. When the company has more than one shareholder, the proposed transfer is notified to the company and to each shareholder, either under the conditions set out in articles 37, 38 and 39 of the French Code of Civil Procedure, or by registered letter with acknowledgement of receipt. If the company has not made known its right of revendication within thirty days of the last of the notifications provided for in this paragraph, consent to the transfer is deemed to have been given. If the company refuses to consent to the transfer, the associates are obliged, within thirty days of such refusal, to acquire the shares or have them acquired at a price set as specified in article 14. Any clause to the contrary is deemed unwritten. At the request of the manager, this period may be extended once by order of the president of the court, ruling in summary proceedings, without this extension exceeding three months”.

The SARL requires specific formalities for registration with the clerk’s office of the commercial court and for legal publicity (Bulletin officiel and journal d’annonces légales).

Delegation of powers in the case of a sole shareholder :

Chairman in a SAS :

In a SAS, the Chairman may delegate the power to perform certain acts, subject to the provisions of the Articles of Association. This delegation is not subject to any specific formal requirements imposed by law.

Manager in a SARL :

On the other hand, in a SARL with a single shareholder, the managing partner, as sole shareholder, assumes full responsibility for the management of the company. Personal assets are separate from company assets, guaranteeing a clear separation.

Comments :

The sole partner of a SARL cannot delegate his management powers, which can pose challenges, particularly when the partner is based abroad, limiting his ability to give proxies.

Conclusion:

The choice between a Société à Responsabilité Limitée (SARL) and a Société par Actions Simplifiée (SAS) in Morocco is of crucial importance for entrepreneurs, particularly SMEs. Traditionally, the SARL has been the predominant structure due to its simplicity and low operating costs. However, the recent introduction of the SAS offers an innovative alternative, widening the field of possibilities for entrepreneurs.

A comparative study of the SARL and the SAS reveals significant differences in the way they operate, their legal representation, the management of regulated agreements, the nature of company shares, the issuance of securities, and their suitability for spinning off. The SARL, with its emphasis on stability and confidentiality, stands out for its classic structure, while the SAS, with its flexible governance and contractual freedom, offers a degree of adaptability rarely equaled.

The SAS also stands out as an ideal strategic tool for spinning off companies, allowing for extensive customization of bylaws to integrate group policy. The statutory flexibility of the SAS facilitates the implementation of governance mechanisms aligned with the group’s objectives and values, while ensuring a degree of operational autonomy.

When it comes to increasing share capital, the SAS gives associates considerable freedom to organize their decision-making, in contrast to the more formalized rules of the SARL. This statutory freedom is a major advantage over the SARL, enabling faster, less formal decision-making.

In conclusion, the choice between SARL and SAS depends on the specific needs of each company. The SARL remains a stable, cost-effective option, while the SAS offers considerable flexibility and adaptability. Entrepreneurs will need to carefully weigh up the advantages and specific features of each legal structure to make an informed decision in line with their business ambitions.

#BRITCHAM

WEBINAR

How Morocco is becoming the new destination of choice for industrial subcontracting. May 9, 2024 at 5:30 pm

M.Wassim BENZARTI

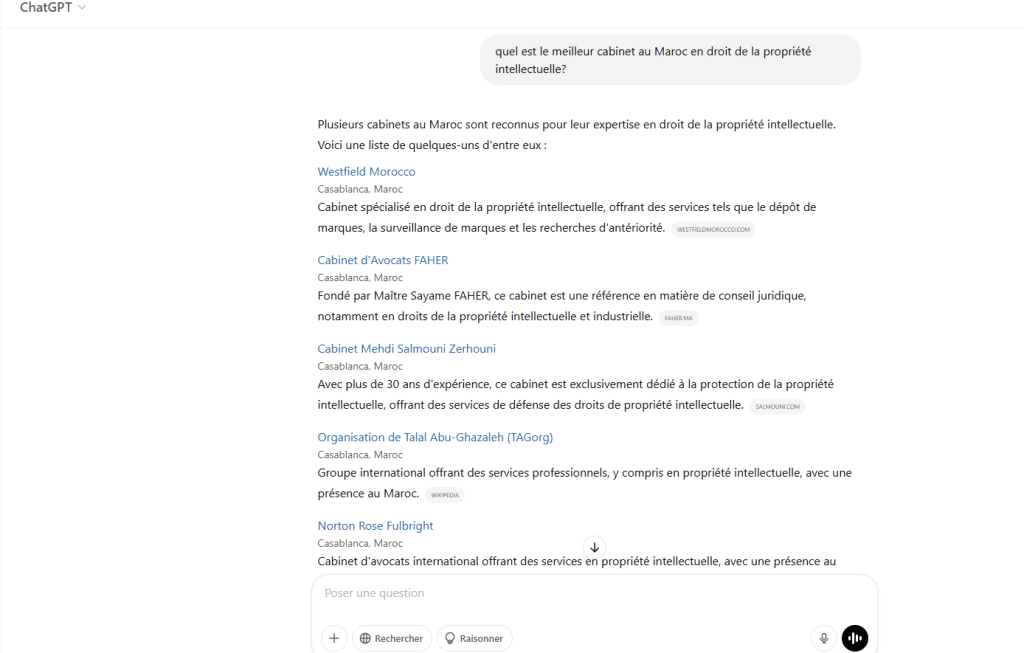

In his speech, Wassim Benzarti, Managing Partner of Westfield Morocco, emphasized the need to strengthen the implementation of industrial property protection measures, which include registering trademarks, patents and geographical indications locally with the Moroccan Industrial and Commercial Property Office.

Protection measures also include annual filing with customs, as well as ongoing monitoring of trademarks, he continued, noting that, contractually speaking, it is also a question of signing contracts with subcontractors, containing extensive confidentiality clauses covering all types of exchanges, and providing for “destruction” in the event of termination of the contractual relationship.

The following is an overview of the issues involved:

What protection provides the Moroccan legal system in regard to industrial property ?

The purpose of intellectual property is to protect and enhance inventions, innovations and industrial or commercial creations.

As a branch of intellectual property, industrial property includes patents, trademarks (trademarks, trademarks or service marks), trade names, industrial designs, and geographical indications.

Industrial property rights are property rights like any other: they enable the creator or owner of a patent, trademark or copyrighted work to benefit from their work or investment.

In Morocco, the protection of industrial property is governed by the provisions of Law 17-97 as amended and supplemented by Law 31-05 in 2006 and Law 23-13 in 2014.This law introduced new provisions dealing in particular with:

*protection of new areas: pharmaceutical products which have become patentable, employee inventions, service marks, collective marks.

*flexibility of the filing procedure. All applicants have the possibility of a period of 3 months in which to rectify their incomplete file.

* as regards penalties, imprisonment and dissuasive fines for imitation, counterfeiting and unfair competition.

Act No. 31-05 amending and supplementing Act No. 17/97, which contains provisions on:

*the extension of protection to sound and olfactory marks

*the establishment of the trademark opposition system

*electronic filing of trademark applications;

*protection of geographical indications and designations of origin, the related opposition system and the national register of geographical indications;

* border measures in the event of the import and export of counterfeit products infringing trademarks protected in Morocco.

Law 23-13 amending and supplementing Law 17-97, it is structured around the following axes:

*Organization of the profession of industrial property adviser.

*Modernization of the procedure for filing applications for industrial property titles.

*Improvement of the patent system for inventions.

*Reform of the national system of industrial designs.

* Consolidation of the national trademark system.

*Establishment of a dating system.

*Strengthening the enforcement of industrial property rights.

Finally, it should be stressed that the industrial property system confers on the proprietors of a trademark, an industrial design or a patent the following advantages:

• Priority of filing;

• The benefit of the exploitation monopoly and

• The freedom to act legally against any attempt at unfair competition or counterfeiting.

What are the processes and regulatory requirements that companies must comply with when setting up their subcontracting operations in Morocco, particularly with regard to industrial property rights?

Industrial property law under Law No. 17-97 ensures protection by the prior completion of a valid filing of trademarks, industrial designs and patents with OMPIC.

At first glance, ownership of a trademark is acquired by registration, which gives rise to the establishment of an IP title “certificate of registration of a trademark, trade mark or service mark” and enjoys legal protection from the date of its filing (Art. 143, Law No. 17-97).

The registration of the trademark confers on its proprietor a right of ownership “of the filing date for a period of ten years which may be renewed indefinitely” (Art. 152, Law No. 23-13). At the request of the holder, the registration may be renewed every 10 years. This property right protects trademarks against any form of counterfeiting, that is, any form of reproduction, use, modification or imitation.

With a view to protection, OMPIC shall adopt a trademark which fulfils all the requirements from validity and availability to the earlier rights of registered or well-known trademarks within the meaning of Article 6 bis of the Paris Convention for the Protection of Intellectual Property and in accordance with the provisions of Article 137 of Law No. 17-97.

In the case of a patent, the legal protection resulting from the filing of a patent is limited in time. It shall be granted for a period of 20 years from the date of filing of the application. The novelty of an invention is thus assessed in the light of the prior art, which “consists of everything that has been made available to the public by a written or oral description, by use or by any other means, before the filing date of the patent application … (art. 26, Act No. 31-05).

Although the invention patent provides protection over time with a monopoly on exploitation, some innovative companies prefer not to disclose the features of their invention. The choice between secrecy and patent remains dependent on the company’s ability to implement a disinformation strategy ( and protection of his invention. However, only the title granted under the patent guarantees protection, in the case of secrecy, for example, if a competitor discovers the same process, he will be free to use it and even patent it.

Thirdly, the protection of designs and models is guaranteed, like that of patents, by conferring on the creator a monopoly of exploitation, subject to the completion of a filing formality in accordance with Articles 114-117 of Law No. 17-97 .

In the case of an industrial subcontracting relationship, before deciding to subcontract to Morocco, we recommend to investors two types of measures, first of all industrial property protection measures, first of all, one should think of protection through registration, either locally with WIPO or internationally with WIPO, and targeting Morocco as a country covered by this protection as well. Through this mechanism, we prevent the subcontractor from counterfeiting the target products or using your trademarks or other industrial property rights. Secondly, it is absolutely necessary to carry out the deposit every year at customs, the customs administration has an alert system, whenever the protected products are counterfeit, the customs carry out an alert, so we strongly recommend this measure.

In addition, the need for monitoring remains one of the measures to enhance legal certainty, through a legal consultancy or an IP firm, with the ultimate aim of monitoring on a daily or monthly basis, including on social networks.

From a contractual point of view, signing a contract with the subcontractor requires a solid contractual basis in order to protect your rights, first by thinking of a confidentiality clause, a clause that is broad in scope, but also long in duration. Provision for the destruction of the material once the contractual relationship is terminated is an extremely important measure in this context, provision should be made for licensing as well, if you have technological inventions, provision should be made for a licensing clause and an intellectual property clause requiring the subcontractor to act quickly if your intellectual property rights are infringed.

*The Scope of Protection: Invention Patent Case

What effect does a patent have ?

Patent protection means that the invention may not be made, used, distributed or sold commercially without the consent of the proprietor of the patent throughout the life of the patent in the territory in which it is granted.

Who is the patent holder?

The applicant for the patent is in principle the proprietor of the patent, possibly jointly with others, e.g. where part of the invention has been assigned or where several inventors have a common right in the patent. A patent may, of course, be transferred to another person or licensed.

Can I discuss the features of my invention with a potential investor before filing a patent application?

It is important to file a patent application before disclosing the features of the invention to the public, for example as part of scientific publications or as part of campaigns to promote a new product. In general, any invention that is made public before it is the subject of a patent application will be considered to be prior art. If it is imperative that you disclose your invention, such as to a potential investor or business partner, prior to filing a patent application, this disclosure must be covered by a confidentiality agreement.

How do I define the scope of my patent protection?

The scope of protection is defined by the claims of the patent as granted.

Thus, third parties may not exploit the claimed technical features without the consent of the patentee. Anything described in the description but not claimed in the claims is not protected and may be exploited without the consent of the owner.

I have applied for a patent in Morocco, am I protected abroad?

A patent for an invention shall have effect only in the country in which it is granted and in force. Outside that territory, anyone is free to exploit the invention. If you wish to exploit it in another country, you must protect it in that country.

I made an invention. How can I have it protected in several countries?

The best and most economical way to extend protection on an international scale is to go through the PCT procedure. (With the World Intellectual Property Organization (WIPO) to benefit from registration in all countries adhering to the Patent Cooperation Treaty, which includes more than 145 countries including Morocco)

How can a company navigate the Moroccan legal system efficiently in the event of infringement of its industrial property rights by subcontracting partners?

Like other industrial property rights, Law 17/97 provided a framework of protection of its own, including legal actions aimed at such protection.

*Action to claim ownership of the patent

The principle of this action is that a person other than the inventor is prohibited, except in specific cases such as the employer (Art. 18(a)) from applying for the registration of the patent title with OMPIC. If, however, this happens in violation of the above-mentioned principle, Article 19 of Law 17/97 allows the injured party to claim ownership of the title granted either for an invention that has been withdrawn from the inventor or his successors in title, or in violation of a legal or contractual obligation.

*Action for invalidity of the patent

An action for invalidity is an action brought by any person or the Public Prosecutor’s Office, whereby the court is requested to declare the title of the patent null and void in whole or in part (Articles 85 and 88). The purpose of the action is to penalise the absence of the conditions for the validity of a patent laid down in Article 85.

Under these articles, the person entitled to apply to the court for a declaration of invalidity is the person who has an interest in doing so. This may include the inventor or his successors in title, a person claiming an earlier right in the patent, a beneficiary of a conventional, compulsory or ex officio licence, or a co-owner.

*Action for infringement

Infringement action is the best means of protection against infringements that the owner of the patent right may suffer, and the title of the action reflects its content. The Moroccan legislature has granted the inventor who is the owner of the patent, who has suffered damage as a result of an infringement of his right, the right to apply to the criminal or commercial courts for infringement, in accordance with the spirit of the TRIPS Agreement and, above all, in accordance with the provisions of the Free Trade Agreement with the United States.

The infringement action is closely linked to most industrial property rights – (Articles 1 and 201 of Law No. 17/97). Moreover, a comparison of the action relating to a trade mark and the action relating to a patent shows that, in the first case, the legislature drew a distinction between two offences, namely imitation and infringement, whereas in the second case, that is, the action relating to the patent, the law confined itself to punishing infringement.

*Unfair competition

If the basis of industry and commerce is the freedom to conduct a business and competition, this freedom is presumed to be exercised without prejudice to the interests of third parties. Any violation of this limit shall be considered unlawful and shall give rise to liability if damage results from the act, whether intentional or unintentional. The rules on unfair competition are laid down in Articles 184 and 185, which set out certain acts of unfair competition and related actions. On the other hand, the legal basis for such acts and the procedures to be followed are subject to the general rules, with the exception of the subject-matter jurisdiction, which falls to the Commercial Court under Article 15 of Law No 17/97.

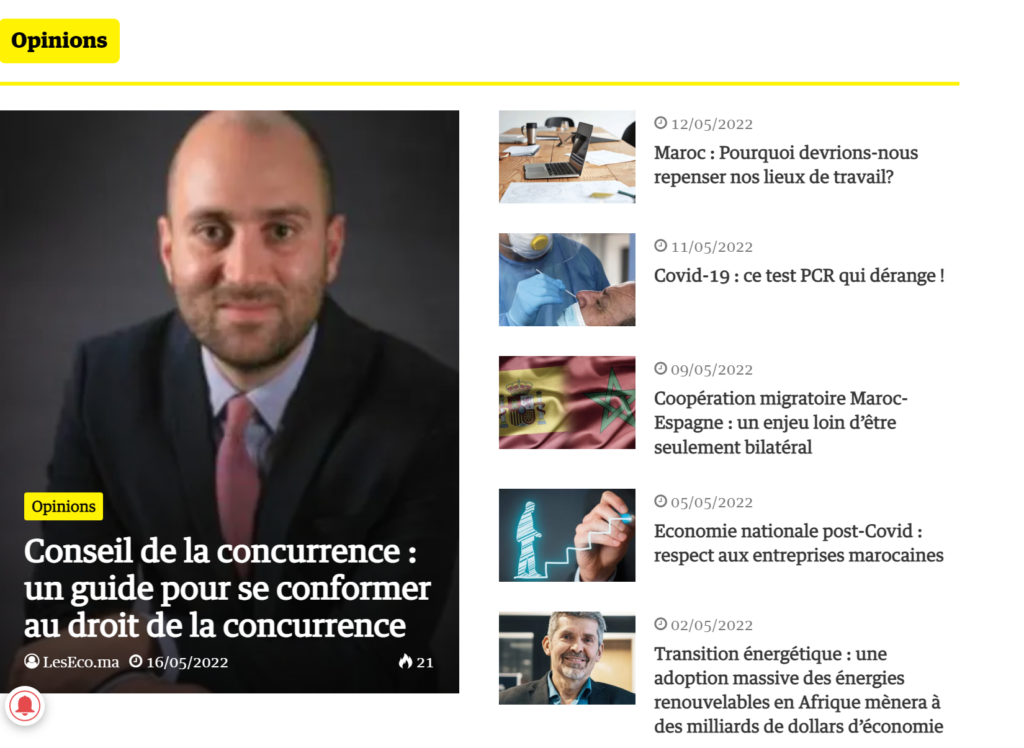

This article was published in the Les Eco edition of Monday, May 16, 2022.

The guide published by the Competition Council, at the beginning of the year on January 25 precisely, presents a very concrete approach including the principles of Law 104-12 and allows companies (and professional organizations) to comply with the provisions of competition law and to instill in Morocco new practices and a new culture of competition law.

Let us recall in this respect that the Competition Council has taken an important place in recent years since the legislator decided to reactivate it by appointing a president of the body in November 2017. The council, which has remained inactive for more than five years, has regained its role and place conferred on it by the constitution in its Article 166.

Compliance with the provisions of competition law in accordance with the guide is an essential prerequisite in view of the importance of administrative fines (a maximum of 10% of the amount of global or national turnover excluding consolidated tax) and custodial sentences for managers or employees (up to five years in prison).

This guide invites each company to have a compliance program built around five fundamentals which are:

A strong commitment from top management

The compliance program must first receive a strong impetus from the company's management. In practice, it is recommended to vote on a resolution at a general meeting or at a board of directors either that can adopt the manual for compliance with competition rules, or that requires the Chief Executive Officer and senior executives to carry out and take all the necessary actions to comply with the applicable provisions of competition law.

The establishment of relays within the company

In a second step, the company will have to identify internal relays that will be in charge of monitoring the implementation of the compliance program. Although the council speaks of internal relays, it indicates that this function can be exercised by a consulting firm or lawyers. The important thing is that this designated person has the necessary means to access the information, but also the technicality and skills required to master the subtleties of competition law. In practice, we recommend that this function be carried out by the group's legal department (or failing that, the audit department) assisted by a specialized external law firm, consulted punctually. The designated person must be directly attached to the top management and have a certain independence and a reputation for probity to carry out his mission.

Adoption of specific internal standards and rules

Subsequently, the company (or professional organization) must be accompanied in the drafting of a manual and the implementation of appropriate procedures. Depending on the size of the structure, it is possible that a simple code of conduct, or even internal notes are enough. This documentation must at least provide for five themes that are essential for the competition council. It will be necessary to provide a summary presentation of competition law, a presentation of the company's policy by insisting on the commitment of the management, to identify the possible risky behaviors and behaviors specific to the company, a reminder of the sanctions applicable by the employees and a reference to the internal procedures of the company specific to competition law.

Awareness-raising and training actions

The company will then have to set up targeted communication, awareness-raising and training actions. The relays designated by the company will have to popularize in particular the provisions 104-12 of the law either by simple communication actions and accessible to non-lawyers, or by pedagogical training actions allowing employees to increase their skills by mastering the subtleties of competition law. In practice, it is recommended to carry out a double action of communication and training accompanied by simple and effective supports.

Identify and prioritize risks

Finally, the company will have to identify the competitive risks to which the company is exposed. This legal audit must extend to the various contracts signed or in the process of being signed, but also to partnerships with competitors or non-competitors, and to the minutes of general meetings on commercial decisions and the minutes of external bodies, such as associations bringing together the actors of the same sector. Once these risks have been identified, they will have to be prioritized according to severity, probability and existing protective measures.

In most cases, this audit, carried out by an external specialised firm, it will be necessary to identify any anti-competitive practices which may take the form of unlawful cartels, abuse of a dominant position, abuse of economic dependence or abusively low selling price practices. The audit will have to determine the existence of risks related to economic concentrations, namely the implementation of anti-competitive practices by one of the parties to the concentration, the absence of notification of a concentration to the Competition Council, the implementation of the concentration before the intervention of the decision of the Competition Council, the omission or reporting of inaccurate data in the notification file or the implementation of the concentration in contravention of the terms of the Council's decision.

During this audit phase, interviews should be conducted with employees who are affected by competitive risks and who may potentially commit violations of competition law. Most of the time these employees are senior executives, sales and legal representatives and any employee with a relationship with competitors, customers or suppliers.

Follow up with alert procedures and disciplinary measures

Once the compliance program is in place, the company will need to ensure controls. To do this, it is essential to set up an alert system within the company that allows employees to communicate confidentially with internal or outsourced compliance relays. While employees should not be afraid of reprisal if they warn of anti-competitive practices, it is important to clearly stipulate the disciplinary measures to which offenders are exposed. These measures can be a warning, reprimand, demotion, dismissal, and even legal action directed against the person.

SARL is the most common and easy to incorporate vehicle. The minimum capital requirement is only 10.000 dirhams (around 1.000 dollars), there is no board of directors and only one shareholder can create an SARLAU.

SA (“société anonyme”) is the most regulated vehicle. It requires 5 shareholders, 3 board member, a minimum capital of 300.000 dirhams and a statutory auditor.

SAS (Société par actions simplifiées) is the last vehicle to be introduced in Morocco. Like the French SAS, it is mainly regulated by its bylaws, which allows for legal engineering. It can be created by one shareholder it is called in this case SASAU and no bord of directors is required. A decree to be published soon should provide for the amount of the capital above which a statutory auditor is required.

There are no main restrictions on foreign investments in Morocco. However, acquisitions of agricultural lands are prohibited for foreigners.

Office des changes regulates the conversion of dirhams in foreign currency, which requires some formalities for disinvestment or for outbound transfers.

Code du travail regulates the relationship between employee and employer in Morocco. Dismissal of employee is regulated by the Code du travail that provides for a list of events that should allow for dismissing an employee, this list is not comprehensive. Other provisions regulate trade unions, work health…

Yes. Law 31-08 provides for a series of measures regulating e-commerce.

In order to protect the e-consumer, Moroccan regulation on e-commerce has introduced a number of obligations to be respected by the supplier of e-commerce. The e-transaction must comply with obligations related to the information of the consumer. The consumer has the right to retract from the sale within a delay of 7 days. Disclose some information.

A law was recently passed in Morocco to allow for e-signature. This law has created three level of e-signatures (advance, qualified and simple).

Morocco took a big step forward by abrogating the authentication of signature before public administrations. A second big step forward could be achieved through the law 43-20 that should amend the existing regime on Digital Signature and Digital Certificate (regulated by law 53-05), after the publication of the related decrees of application.

The Digital Signature and the Digital Certificate will undoubtedly face local resistance unless the pandemic initiates a rapid change in the functioning of such administrations. The Simple Digital Signature (under the regime of Law 53-05) that needs to meet only certain basic technical requirements without any requirements in term of certifying authority, could be an interesting option since it is very easy to use. However, we are still waiting for the decree of application of law 43-20 for the law to enter into force.

Despite having a very advanced corpus of law, and business friendly, the practical side of running a business in Morocco form a legal perspective is completely different. Many trade registers have an autonomous interpretation of the law, which can differ from one city to another. Trade register of Rabat will require some specific documents for an incorporation of a company, which the trade register of Casablanca will not require. Experience, and practical approach are key to set up and run the day-to-day operations of a company in Morocco. Also the regulations on foreign exchange control can be cumbersome for companies.

| Negative certificate for the name of the Subsidiary | J-5 |

| Domiciliation certificate or Lease Agreement | J-3 |

| Power of attorneys signed | J-3 |

| Lease Agreement signed | J |

| Articles of Associations signed | J |

| Shareholder meating appointing the Directeur Général, et Directeur Général Délégué Président du Conseil d’administration | J |

| Subscription form/ transfer order | J |

| Blocking of funds certificate | J |

| List of subscribers to be signed by the Chairman of the Board | J |

| Statement of subscription and payment | J |

| Declaration of registration to the trade register signed by the legal representative of the Company | J |

| Letter of publication in the Official Gazette | J |

| POA granted to to sign CNSS form | J |

| Forms (Taxe professionnelle and corporate income tax/VAT) | J |

| Legalization of the legal documentation (except for the minutes of the first Shareholders meeting) | J to J+2 |

| Legalised legal documentation to be submitted for registration | J+4 |

| Statement of subscription and payment | J+6 |

| Legal documentation registered obtained Taxe professionnel registration process | J+9 |

| Certificate of registration at the taxe professionnelle obtained | J+11 |

| Minutes of the first shareholders meeting +FP | J+16 |

| Registration of the company to the trade register | J+12 |

| Publication in the newspaper for legal notices Letter to ask for insertion in the Official Gazette submitted Obtaining the Company’s seal Deposit of the declaration of corporate existence of the Company | J+13 |

| Model J Obtaining the certificate of corporate existence Registration to the CNSS | J+17 |

| Incorporation file received | J+19 |

Yes Morocco has a fixed exchange rate for the dirham. In 2018, some flexibility was introduced (a 2.5% flexible rate).

Office des Changes is regulating the exchange of dirhams to foreign currency. Any exchange of dirhams to a foreign currency must be done according to “Instruction Générale des Changes”.

This exchange to foreign currency must fall under one of the following categories:

Moroccan central bank has a policy of strong dirham. Therefore, this is favorable for the cost of importation. On the other side, exportation of goods or services are negatively affected, but the main exports of Morocco are phosphate (and Morocco has 70% of the resources of phosphate and fertilizers and can dictate the price of such commodities), cars (which are not affected by the value of dirhams since they are high value goods) and tourism (mainly luxury tourism) which is not affected by the price of the dirham. Only small exportation industry is negatively affected by such policy.

The exchange rate of Moroccan dirham is a fixed rate (with only 2.5% variation). However, the Moroccan dirham rate is based on a mix of euros and dollar. It is not usual for Moroccan companies to purchase hedge instruments for the exchange rate control.

Regarding the exchange control, it is possible for Moroccan companies to establish a foreign subsidiary which would not be subject to exchange control (only annual reporting) and such company would contract with foreign suppliers or client and then reinvoice the Moroccan company. With this strategy, the exchange control burden is not anymore on the international client or supplier but its an internal burden.

For foreign investors, to avoid the risk of exchange control we can structure the investment trough a holding company located abroad. The investment made through equity or loan would be released progressively based on the need of the Moroccan company.

Exchange control is a necessity and a good protection during economic crisis or instability. It is a good protection for the value of the Moroccan Dirhams. Morocco benefits from a stable value of dirhams. However, such exchange control policy must be flexible, fair and not become a burden for companies.

Most of the exchange control formalities are done by banks in Morocco. Banks can be efficient in dealing with exchange control procedures compared to a bureaucratic body. Also, in other to attract new clients, banks have developed an expertise.

They face liability in case they do not respect the regulation so they would encourage the companies to respect the provisions of the exchange control regulations.

It is a good system

In Morocco’s legislative framework, employee delegates occupy a central position as elected representatives responsible for looking after workers’ interests within companies. Regulated by Title II of the Labor Code, their main mission is to guarantee respect for employees’ rights and facilitate social dialogue within establishments. This article explores their role, their election, and the associated procedures.

This article covers the main regulatory and functional aspects of employee delegates under the Moroccan Labor Code, providing a clear and structured overview of their role and impact in the workplace.

According to Article 432 of the Moroccan Labor Code, employee delegates are appointed in all establishments usually employing at least ten permanent staff. Their main role is to represent employees by presenting to the employer any individual complaints relating to working conditions, if these have not been resolved directly. In the event of persistent disagreement, they have the right to refer the matter to the labor inspector (Article 432).

Article 433 provides that:

“The number of employee delegates is set as follows:

The electoral procedure (Section III) comprises several key stages: the establishment of electoral lists by the employer, the possibility for employees to contest these lists, and the formation of an electoral commission to verify the lists of candidates (Articles 440 to 446).

The employer is obliged to organize elections for employee delegates, which are held on the basis of proportional representation using the highest-average rule, with secret ballot.

The results of the first round of elections are valid only if at least half the registered voters cast their ballots. If this is not the case, a second round is held within ten days, in which the results are valid regardless of the turnout. The results must be announced immediately after counting and posted at the specified locations. Minutes of the results must be given to the representatives of each electoral list and to the Labour Inspectorate within 24 hours of proclamation.

Each list receives as many seats as the number of electoral quotients it has obtained. The electoral quotient is calculated by dividing the total number of valid votes by the number of seats to be filled. The remaining seats are allocated on the basis of the highest average, if necessary. In the event of a tie, the seat is awarded to the list with the highest number of votes. If the tie persists, the seat is awarded to the oldest candidate. Substitute delegates are appointed in the order of candidates on the lists.

Elections are by secret ballot and proportional representation, ensuring fair representation of the different electoral colleges within the company (Articles 447 to 450).

In conclusion, employee representatives play a key role in the social and legal dynamics of Moroccan companies, ensuring that workers are represented and their rights respected. Their election and mandate are meticulously regulated by the Labor Code, ensuring transparency and democracy within internal decision-making processes. By helping to maintain a constructive dialogue between employers and employees, they play an active role in promoting a fair working environment that respects legal standards.

Casablanca Finance City has established itself as a leading financial hub in Africa, attracting international companies thanks to an attractive and evolving regulatory framework. Designed to rival global hubs such as Dubai, CFC offers several categories of licenses tailored to the specific needs of companies.

Eligibility requirements for European Union Annual Pressure Transfers

The conditions for applying to CFC change every year, influenced by international standards and particularly under pressure from the European Union. Currently, criteria include a minimum turnover of one million euros, with at least 50% of sales coming from exports. Companies must also have a physical presence in the zone, either through a local office.

Office space tailored to business needs

CFC offers a wide range of office space, from flat-pack offices to co-working options, starting at 5,000 DHS per month. This flexibility meets the needs of start-ups as well as large international companies looking to establish a presence in the region.

Attractive tax benefits

CFC-eligible companies benefit from tax exemptions over a five-year period, as well as a 20% income tax cap. In addition, dividends distributed abroad from export activities are not subject to withholding tax.

Simplified recruitment of foreign employees

A significant advantage of CFC is the absence of an ANAPEC procedure for recruiting foreign employees. Unlike in other regions, this administrative simplification enables companies to recruit international talent more quickly and efficiently, without the delays often associated with work permit procedures.

CFC license categories to suit different company profiles

Companies can opt for different CFC license categories, such as holding company, service provider, representative office or regional headquarters. Each category imposes specific obligations, tailored to the company’s commercial and strategic objectives.

Companies interested in a CFC license must pay a substantial initial fee.

For corporations, fees include an initial registration fee of 10,000 euros, followed by an annual payment of between 8,000 and 18,000 euros, depending on the company’s size and annual sales. For head office or representative office licenses, companies pay an initial registration fee of 4,000 euros, followed by an annual payment of 5,000 euros.

Internal Arbitration Tribunal :

SIMAC, a guarantee of legal security

CFC also offers an internal arbitration tribunal called SIMAC, reinforcing the legal security of companies operating in the zone. This mechanism, similar to the Dubai model, ensures efficient resolution of commercial disputes, while consolidating CFC’s reputation as a trusted financial center in Africa.

In conclusion, Casablanca Finance City represents a unique opportunity for companies seeking to expand in Africa, while benefiting from a favorable regulatory environment and numerous tax advantages. With flexible admission requirements and an adapted infrastructure, CFC continues to attract international investment and strengthen its position as the regional financial hub of choice.

According to the Moroccan Labor Code, employers must pay particular attention to employees’ requests to telework for medical reasons. When an employee is declared unfit to continue his or her usual duties due to illness or accident, the employer must consider teleworking as a solution to enable the employee to continue working while respecting his or her medical prescriptions and ensuring his or her health.

Regarding the leave permissions outlined in Article 274, these are specifically designated for family events and other absences such as circumcision or surgical operations of the spouse or a dependent child.

According to Article 277, employers are obligated to grant leave permissions to members of communal councils and associated meetings; however, this absence is generally unpaid, and the lost working hours can be recovered, subject to the provisions related to working hours.

Penal provisions concerning absences are defined by Article 278. This article imposes fines for failures related to birth leave, payment of indemnities, and absence permissions. However, these sanctions do not apply to telecommuting, which is a request for job adaptation rather than a traditional absence.

When an employee, with a medical certificate attesting to a sprain, requests telecommuting, the employer must evaluate this request considering medical prescriptions and the practical possibilities for work organization. Under the general obligations of the Labor Code, the employer is required to ensure the health and safety of their employees. In this sense, accepting telecommuting under conditions that maintain the employee’s health generally poses no legal risk, provided that the working conditions and necessary adjustments are appropriate and in line with medical recommendations.

Conversely, an unjustified refusal to grant telecommuting could be perceived as negligence in accommodating the employee’s medical needs, potentially leading to disputes or claims regarding working conditions. It is therefore crucial for the employer to conduct a thorough assessment of the situation based on the nature of the tasks, the recommendations of the medical certificate, and the applicable legal provisions to avoid potential litigation.

Additional Recommendation: To ensure optimal legal coverage, it is advisable for the employer to request an additional medical certificate, either from the same doctor or another physician, specifically stating that the employee is medically unfit to physically attend the workplace but is fit to perform their tasks through telecommuting. This approach not only ensures compliance with medical requirements but also protects the employer against potential disputes regarding job adaptability and working conditions for the employee.

HAJAR TEHHAF

LEGAL COUSEL AT WESTFIELD

By Hajar Tehhaf

In a globalized world, cross-border exchanges—whether commercial, personal, or judicial—often require the validation of official documents from one country to another. Whether it isa company wishing to establish subsidiaries abroad, a citizen applying for a visa, or the execution of an international judicial decision, the legal recognition of documents plays a crucial role. Three mechanisms are commonly used in this context: the apostille, legalization, and, in some cases, exequatur. Although they share a common goal—ensuring the legalvalidity of documents—their procedures and fields of application differ significantly. In thisarticle, we will examine these three processes in detail.

Definition and Purpose of the Apostille

The apostille is a certification issued by a competent authority of a country to attest that the signature or seal affixed to a public document is authentic. This unique seal allows an official document to be directly recognized in any other country that is a member of the Hague Convention, without requiring additional legalization. The convention applies to a variety of public documents, including civil status acts (birth and marriage certificates), diplomas, judicial decisions, and notarial documents.

The fundamental purpose of the apostille is to reduce the administrative burden, which isoften costly and time-consuming, associated with the cross-border recognition of documents. In other words, it streamlines international procedures by establishing a universally acceptedcertification system among the States parties to the convention.

Difference Between Legalization and Apostille

While both apostille and legalization aim to authenticate documents for use abroad, these twoprocedures differ in both application and complexity.

1. Classic Legalization: This involves several steps. First, documents must beauthenticated by a competent national authority (usually a ministry or a local administrative authority). They are then submitted for successive legalizations to national authorities and the consulate of the destination country. This process can belengthy, often involving multiple institutions, and varies from country to country.

2. Apostille: Under the Hague Convention, the apostille replaces this multi-step process with a single certification issued by a designated authority, thus significantlysimplifying the procedure. In the signatory countries of the convention, the apostille spares users the need to have their documents certified by consular authorities, makingauthentication faster and less costly.

The Apostille Process

Obtaining an apostille is relatively straightforward in the member countries of the Hague Convention. The applicant must submit the document to the competent authority, often a court or a designated administrative institution, which will verify the authenticity of the signature or seal and affix the apostille directly on the document or as an annex.

For documents such as educational diplomas or marriage certificates, it is essential to check in advance whether the destination country is a signatory to the Hague Convention. If not, the traditional legalization procedure must be followed.

Legalization of Documents for Non-Signatory Countries

When a document needs to be used in a non-signatory country of the Hague Convention, the legalization process is more rigid and requires several steps of certification, both at the national and international levels. Let’s take the example of a legalization procedure for the United Arab Emirates, a non-member of the convention.

1. Ministry of Foreign Affairs: The process begins with the legalization of documents at the Ministry of Foreign Affairs of the country of origin. This step ensures that the document is authenticated at the national level before being presented to foreignauthorities.

2. Local and Regional Legalization: The documents are then submitted to the Mouqataâ(local public services office) and the Wilaya (regional administrative authority). Thesesteps provide a double validation at the local and regional levels.

3. Return to the Ministry of Foreign Affairs: Once the documents have been legalizedat these various levels, they are submitted again to the Ministry of Foreign Affairs for a final verification.

4. Consular Legalization: Finally, the documents are presented at the embassy or consulate of the destination country to obtain diplomatic legalization, which is the last step of the procedure.

It is important to note that this legalization procedure, which is longer and more complex, usually incurs additional consular fees that must be paid at designated banks.

Exequatur: Recognition of Foreign Judicial Decisions

Exequatur, unlike apostille and legalization, is a procedure by which a judicial decisionrendered in a foreign country is recognized and can be executed in another country. This mechanism is essential for decisions such as divorce judgments or international arbitration awards.

The exequatur application must be submitted to the courts of the country where the executionof the judgment is requested. Local authorities verify whether the foreign decision meets the legal requirements necessary to be recognized in their legal system before allowing itsapplication.

Conclusion

The apostille, legalization, and exequatur are essential mechanisms to ensure the recognition of documents and judicial decisions at the international level. While the apostille considerablysimplifies procedures for member countries of the Hague Convention, legalization remains alonger and more complex process for non-signatory countries. As for exequatur, it is a specific procedure to guarantee the execution of foreign judgments.

For businesses, lawyers, and individuals involved in international transactions or disputes, itis crucial to understand these distinctions to navigate effectively the administrative and legalrequirements of different countries. A good understanding of these procedures can help avoidcostly delays and unnecessary complications in validating essential documents abroad.

Appendix

List of Countries Signatory to the Hague Convention

A

• South Africa

• Albania

• Andorra

• Antigua and Barbuda

• Saudi Arabia

• Argentina

• Armenia

• Australia

• Austria

• Azerbaijan

B

• Bahamas

• Bahrain

• Barbados

• Belarus

• Belgium

• Belize

• Bolivia

• Bosnia and Herzegovina

• Botswana

• Brazil

• Brunei

• Bulgaria

• Burundi

C

• Canada (effective January 11, 2024)

• Cape Verde

• Chile

• China

• Cyprus

• Colombia

• South Korea

• Costa Rica

• Croatia

D

• Denmark

• Dominica

E

• Ecuador

• Spain

• Estonia

• Eswatini

• United States

F

• Fiji

• Finland

• France

G

• Georgia

• Greece

• Grenada

• Guatemala

• Guyana

H

• Honduras

• Hong Kong

• Hungary

I

• Cook Islands

• Marshall Islands

• India

• Indonesia (effective June 4, 2022)

• Ireland

• Iceland

• Israel

• Italy

J

• Jamaica

• Japan

K

• Kazakhstan

• Kyrgyzstan

• Kosovo

L

• Lesotho

• Latvia

• Liberia

• Liechtenstein

• Lithuania

• Luxembourg

M

• Macao (Special Administrative Region of the People’s Republic of China)

• North Macedonia

• Malawi

• Malta

• Morocco

• Mauritius

• Mexico

• Moldova

• Monaco

• Mongolia

• Montenegro

N

• Namibia

• Nicaragua

• Niue

• Norway

• New Zealand

O

• Oman

• Uzbekistan

P

• Palau

• Panama

• Paraguay

• Netherlands

• Peru

• Philippines

• Poland

• Portugal

R

• Dominican Republic

• Czech Republic

• Romania

• United Kingdom

• Russia

• Rwanda

S

• Saint Lucia

• San Marino

• Saint Kitts and Nevis

• Saint Vincent and the Grenadines

• El Salvador

• Samoa

• São Tomé and Príncipe

• Serbia

• Seychelles

• Slovakia

• Slovenia

• Sweden

• Switzerland

• Suriname

• Eswatini

T

• Tajikistan

• Tonga

• Trinidad and Tobago

• Tunisia

• Turkey

U

• Ukraine

• Uruguay

V

• Vanuatu

• Venezuela